Less than half of companies intend to formulate a BCP

- Jun 20, 2017

- 3 min read

- Effects of formulating a BCP, operational efficiency and enhancement of business partners’ trust -

In recent years, preparing disaster prevention and mitigation measures in advance as well as response measures in the event of disaster and after a disaster has become increasingly important, so that business may continue without suspending operations or by restoring the operations promptly, on the assumption that corporate activities will be impacted through various risks such as natural disaster or an information security incident. There are also ongoing, active discussions on cooperation with the community to make the BCP more effective.

Based on this situation, Teikoku Databank has conducted a survey on corporate attitudes toward Business Continuity Planning (BCP). This survey was conducted in conjunction with the May 2017 TDB Trends Research and it is the 2nd survey following that of June 2016.

*Survey period: May 18 - May 31, 2017; Companies Surveyed: 23,983; Valid Responses: 10,142 (Response Rate: 42.3%).

*Details of this survey can be found on the dedicated Economic Trend Survey HP. (http://www.tdb-di.com/)

Survey results (Summary)

1. With respect to company status in terms of formulating a BCP, 14.3% of the companies 'have formulated' a BCP. Even combining those that “are currently formulating” and “are considering formulating” amounts to less than half the companies. By industry, "Finance" has the highest percentage of companies that have formulated a BCP, at 43.8%. "Real Estate" has the lowest, at 9.5%.

2. Among companies that 'have formulated,” “are currently formulating” and “are considering formulating”, highly-ranked risks in which business continuity is assumed to be difficult are "natural disaster (earthquake, storm and flood damage, eruption, etc." (71.8%), "information security risk" (39.1%) and "facility failure" (38.8%). For matters that have been implemented/considered in preparation for business interruption risks, "establishment of means to confirm employees’ safety" (70.6%), "Information system backup" (63.9%) and "ensuring safety of the office" (45.2%) are highly ranked.

3. With respect to the effect of formulating a BCP, "Operational formalization and standardization are advanced" was ranked the top, at 41.4%, for companies that have formulated a BCP, followed by "Operational priority has become clear" (36.9%) and "Increased business partners’ trust" (25.7%). Particularly, among small-scale companies, "Operational priority has become clear" (44.3%) ranked the highest.

4. Reasons for not formulating a BCP were "Do not have the skills and know-how necessary to formulate" with the highest ratio of 45.1%, followed by "Cannot secure human resources to formulate such a plan" (30.3%), and "Ends in document creation, and difficult to make a plan practical-to-use" (25.7%).

5. With respect to cooperation with the community, "Establishment of a contact system in ordinary times" ranked highest, at 42.7%, followed by "Provision of goods in the event of a disaster" (17.7%), and "Execution of a disaster support agreement" (12.0%).

Appendix

1.Research Subjects(Companies Researched 23,983; Valid responses: 10,142; Response rate: 42.3%)

2.Research Items

*Business Confidence (current, in 3 months, in 6 months, in 1 year)

*Business Conditions (sales, purchasing and selling unit price, inventory, capacity utilization ratio, number of employees, overtime work hours)

3.Research Period and Methodology

Internet-based survey conducted May 18 – 31 2017

The explanation of the Economic Diffusion Index

Research Purpose/Researched Terms

TDB Economic Trend Research (started from May 2002) is a monthly statistical survey conducted for over 20,000 nationwide corporations on their general business activities including the current condition and future outlook of the industry business performance and operating climate. The primary purpose of such a survey is to assess the current state of Japan’s economy.

Selection of the Subject Corporations

Companies of all sizes in all domestic industries are eligible to participate in the survey.

DI Formula

The DI (Diffusion Index) is calculated by attaching a number (in parenthesis in the diagram below) to each of seven possible responses. Then multiplying the percentage of each response by the appropriate number, and adding the results.

A DI over 50 is in the range of “Good.” A score under 50 is “Bad.” The number 50 is the dividing point (“Neither Good or Bad”). All numbers are rounded off to the hundredth. It should be noted that no weight is given to a company’s responses based on its size. Calculations are made according to a “one company, one vote” rule.

.

For example, all corporations rated ‘Very Good’.

DI=6/6x100(%)=100

All corporations rated ‘Neither Good nor Bad’.

DI=3/6x100(%)=50

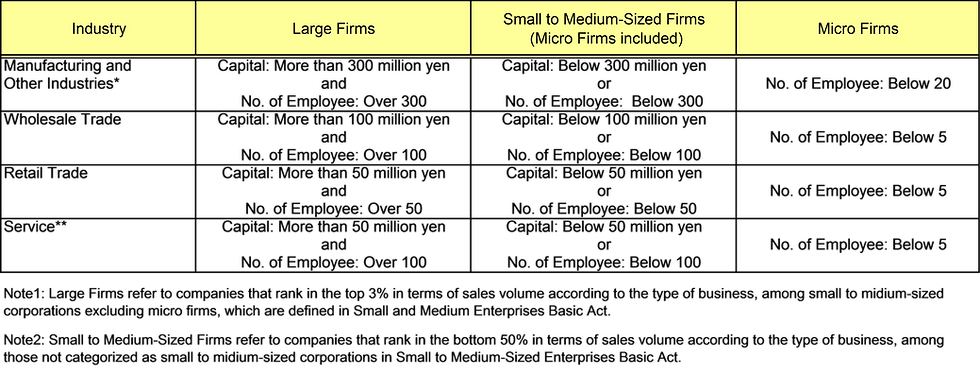

Size Classification

Comments